philadelphia wage tax work from home

Taxation of payments received from an employer in exchange for labour or services is subject to the Income Tax Act of 1961 the Act. Those same non-resident workers are exempt from the tax when their employer requires them to work outside of.

How To Get Your Philly Wage Tax Refund Morning Newsletter

The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic.

. The exemption from the wage tax only applies if a Philadelphia-based employee is required to work outside the city. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. A corporation with physical presence is subject to corporate net income tax unless its activities are protected by PL.

As pandemic-related restrictions are being lifted in Philadelphia the Citys Wage Tax rules will apply to remote work arrangements. Philadelphia previously published guidance indicating if employees were required to work outside of the city by their employer they would no longer be subject to the Philadelphia wage tax. But workers who live outside the city and have been told to work from home do not have to pay the tax.

The city of Philadelphia has a wage tax one of the highest in the nation. Need Entry Level Experienced. In addition non-residents who work in Philadelphia are required to pay the Wage Tax.

Philadelphia levies a 34481 wage tax on people who work but dont live in the city. Anyone who works in Philadelphia and lives in Middletown Township is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 34481 as of July 1 2021 of gross wages. Easy applications fast hires.

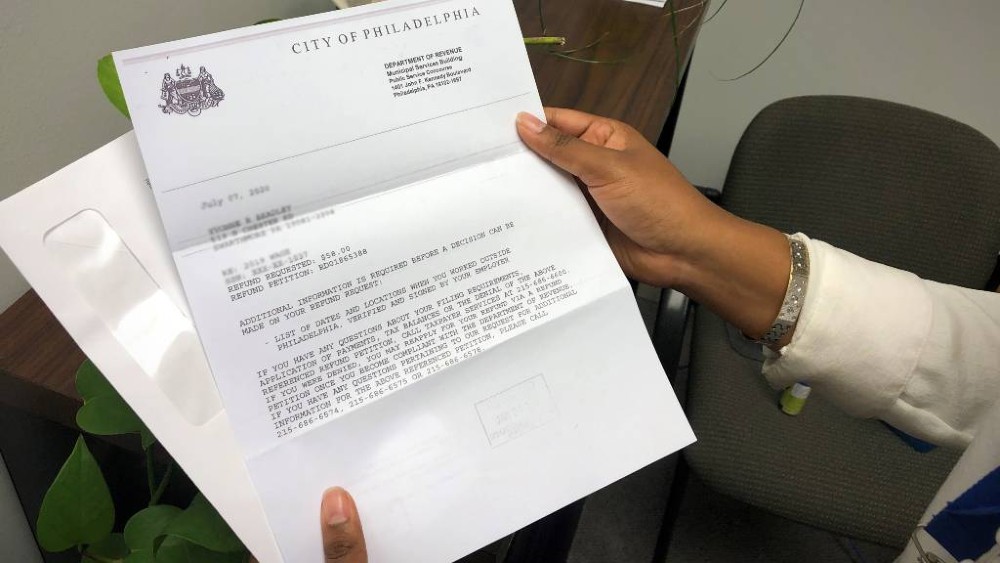

PHILADELPHIA KYW Newsradio Now that many Philadelphia employers have re-opened their offices commuters can expect to begin paying the non-resident wage tax again even if they are still working from their home outside of the city. Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund. The application form is available here.

On May 4 2020 the Philadelphia Department of Revenue updated its guidance for withholding the Wage Tax from nonresident employees who are working in the city temporarily due to COVID-19. While Philadelphia residents are eligible for refunds of City Wage Tax if. Upload W2 1099 and Wage Tax Refund Request.

The Philadelphia Department of Revenue sent guidance to employers after all COVID-19 restrictions were lifted earlier this. Sign Up For Job Alerts. Official website of the City of Philadelphia includes information on municipal services permits licenses and records for citizens and businesses.

Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy. Upon becoming an employer of any of the following in Pennsylvania all employers must register with the City of Philadelphia within 30 days of becoming such an.

People who live in the city no matter where they work must always pay the 38712 resident wage tax. View Local No Experience Openings. If companies allow employees to telecommute after pandemic restrictions are.

That exemption remains in place only if employees are required to work from home. Nonresident employees who mistakenly had Wage Tax withheld during the time they were required to perform their duties from home in 2020 will have the opportunity to. Ad Full time part time jobs available.

The wages of the non-resident employees who are required to and do work at home are not subject to Wage Tax except on the days they report to. All Philadelphia residents must pay the tax regardless of where they work. In addition non-residents who work in Philadelphia are required to pay the Wage Tax.

The city issued new wage tax policy guidance on November 4 th 2020. For those who in the past commuted to Philadelphia there is yet another benefit to working from home beyond saving time gas and tolls. Anyone who works in Philadelphia and lives elsewhere is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 35019 of gross wages.

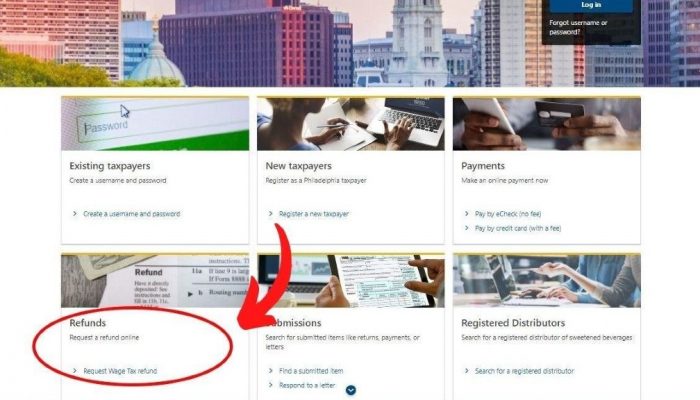

See EY Tax Alert 2020-0751In the updated guidelines the Department states that an employer may continue to. Philadelphia recently issued new streamlined ways to request City Wage Tax refunds that were withheld during the period their employer required to work from home outside of Philadelphia. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia. Normally Philadelphia non-residents employed in the city can get a wage tax. Working remotely has its perks and its challenges so many.

The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken into account. With the pandemic forcing many people to work from home thousands in our area are no longer commuting to work like they used to. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy.

At the end of the 2020 tax year you will be able to file for a Philadelphia Wage Tax refund. The previous guidance was published on March 262020. Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office.

PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. The wage tax accounts for 45 of Philadelphias annual revenue and is expected to decline by about 78 million this fiscal year despite an increase in the nonresident rate. A better way to search for jobs.

Ad All Experience Levels. On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic.

Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. PHILADELPHIA WPVI -- Millions of Americans have been working from home during the pandemic and that could impact your 2020 tax bill. 86-272 which law prohibits a state from imposing a net income tax on income.

If you have questions about this or any other payroll issue please call us at 215-723-4881 or contact us online. As long as companies are requiring employees to work from home they are exempt from the 34481 nonresident tax. The Use and Occupancy Tax rate is 121 of the assessed value of a property with a 2000 annual tax exemption.

Come to work at the Philadelphia work location on a given day and the remaining 80 must work from home. Anyone who works in Philadelphia and lives elsewhere is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 35019 of gross wages.

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Philadelphia City Council Unveils 5b Budget Whyy

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Suburban Workers Reprieve From City Wage Tax Is Ending

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/MASTJCL4ZJBBDONJ5JKW7DLG3I.jpg)

Philly S Ability To Generate Job Growth Could Mean The Difference Between Renaissance Or Stagnation

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Center City Calls To Bring Back Employees To Downtown Philly Whyy

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton